Latest 2019 RPGT Rates in Malaysia 5 Hike Since 2019 Is Malaysian entitled for RPGT exemption. B gains or profits from an.

2020 E Commerce Payments Trends Report Malaysia Country Insights

A gains or profits from a business.

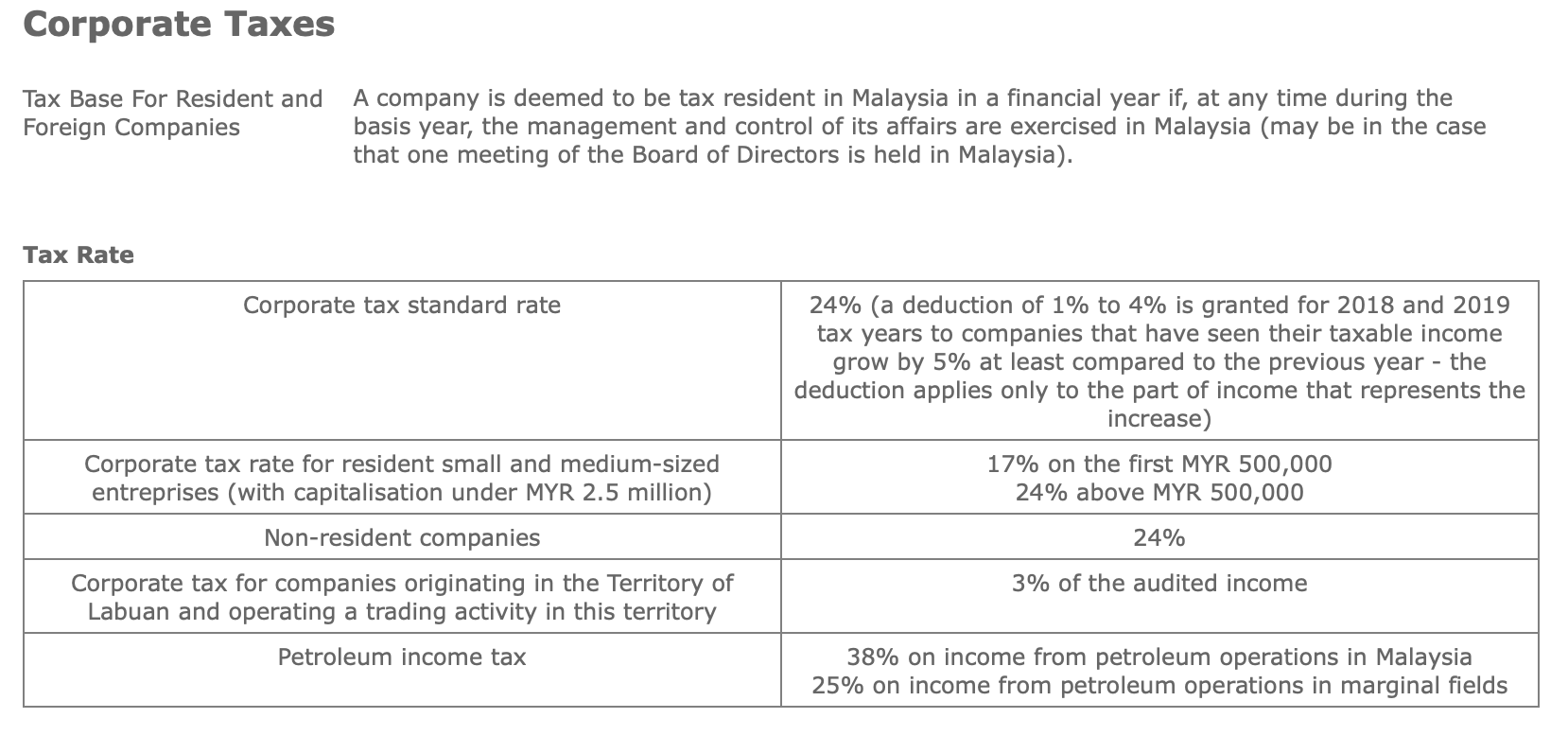

. An effective petroleum income tax rate of 25 applies on income from. The corporate tax rate in Malaysia is collected from. On the First 5000.

On the first RM 600000 chargeable income. Effective from 1 January 2020 individuals who are not Malaysian citizens are subject to RPGT at a rate of 30 for a holding period up to five years and 10 for a holding period exceeding five. Get in touch with us now.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. 13 rows 30. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

In 2019 the tax revenue received in Malaysia amounted to approximately 454 billion US. Here are the income tax rates for personal income tax in Malaysia for YA 2019. You can calculate your taxes based on the formula.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Rate TaxRM A. Paid-up capital up to RM 25 million or less.

On the First 20000 Next 15000. It is Necessary to Be Aware of the Malaysia Corporate Tax Rate 2019 Because It is a Factor in the Success of Your Business. Malaysia Personal Income Tax Rate.

However it has been proposed by the Malaysia Government that beginning on 1 April 2019 excise duty will be introduced on sweetened beverages that are being. For example lets say your annual taxable income is RM48000. For Sales Tax goods other than petroleum products which are.

Following table will give you an idea about corporate tax computation in Malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. On the First 5000 Next 15000.

What supplies are liable to the standard rate. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Based on this amount the income tax to pay the. Yes for Malaysian it is a once in a lifetime so you must not have applied before. There is also an.

10 percent for Sales Tax and 6 percent for Service Tax. Apr 14 2022. 20182019 Malaysian Tax Booklet 8 Classes of income Income tax is chargeable on the following classes of income.

Selling a property less than or equal to 3 years of ownership results in a 30 tax on your net gains and reduces to 20 after the third year and 15 on the fourth year and finally 0. A qualified person defined who is a knowledge worker residing. Tax Rate of Company.

Malaysias revenue from tax had.

Malaysia Economy Population Gdp Inflation Business Trade Fdi Corruption

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Malaysia Corporate Income Tax Rate Tax In Malaysia

India S Big Bang Moment Brink Conversations And Insights On Global Business

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Malaysia Personal Income Tax Rates 2022

Malaysia Awareness Of Artificial Intelligence 2022 Statista

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Special Voluntary Disclosure Programme Commonwealth Association Of Tax Administrators

Solved The Following Tax Rates Allowances And Values Are To Chegg Com

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Dr M Putrajaya To Review Airport Tax Rates Departure Levy Malay Mail

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets